-

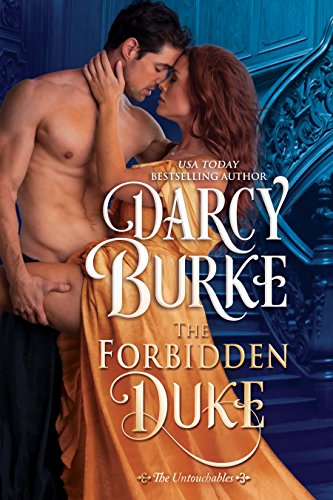

The Forbidden Duke

The Forbidden Duke by Darcy Burke is $2.99! This is a romance between a “ruined” heroine and the man who ruined her. It’s the first book in the Untouchables series.

Spinster Miss Eleanor Lockhart is suddenly homeless and employment is her only option. Ruined after succumbing to a scoundrel’s excessive charm nearly a decade ago, she’s lucky to obtain a position as a paid companion and committed to behaving with the utmost propriety. She definitely shouldn’t be in the arms of a man capable of utterly destroying what little remains of her reputation…

Titus St. John, Duke of Kendal, is known as the Forbidden Duke, a mysterious, intimidating figure who enters Society just once each year at his stepmother’s ball. A decade ago, he was a devil-may-care rake until his idle roguery brought about the ruin of Eleanor Lockhart—and his resulting self-imposed isolation. Now she’s back, and she needs his help. But by “saving” her, he may just ruin her life all over again.

Add to Goodreads To-Read List →

This book is on sale at:

As an Amazon Associate we earn from qualifying purchases.

We also may use affiliate links in our posts, as

well. Thanks! -

Make the Season Bright

Make the Season Bright by Ashley Herring Blake is $1.99! This came out October of last year. Perhaps you’re not the sort to read holiday romances all year long, but it might be worth stocking up when you can.

Two exes find themselves stuck at the same house for Christmas in this holiday romance by Ashley Herring Blake, USA Today bestselling author of Iris Kelly Doesn’t Date.

It’s been five years since Charlotte Donovan was ditched at the altar by her ex-fiancée, and she’s doing more than okay. Sure, her single mother never checks in, but she has her strings ensemble, the Rosalind Quartet, and her life in New York is a dream come true. As the holidays draw near, her ensemble mate Sloane persuades Charlotte and the rest of the quartet to spend Christmas with her family in Colorado—it is much cozier and quieter than Manhattan, and it would guarantee more practice time for the quartet’s upcoming tour. But when Charlotte arrives, she discovers that Sloane’s sister Adele also brought a friend home—and that friend is none other than her ex, Brighton.

All Brighton Fairbrook wanted was to have the holliest, jolliest Christmas—and try to forget that her band kicked her out. But instead, she’s stuck pretending like she and her ex are strangers—which proves to be difficult when Sloane and Adele’s mom signs them all up for a series of Christmas dating events. Charlotte and Brighton are soon entrenched in horseback riding and cookie decorating, but Charlotte still won’t talk to her. Brighton can hardly blame her after what she did.

After a few days, however, things start to slip through. Memories. Music. The way they used to play together—Brighton on guitar, Charlotte on her violin—and it all feels painfully familiar. But it’s all in the past and nothing can melt the ice in their hearts…right?

Add to Goodreads To-Read List →

This book is on sale at:

As an Amazon Associate we earn from qualifying purchases.

We also may use affiliate links in our posts, as

well. Thanks! -

The Ballad of Smallhope and Pennyroyal

The Ballad of Smallhope and Pennyroyal by Jodi Taylor is 99c! This book has a pair of time traveling bounty hunters. I’m unsure if this is related to Taylor’s other time travel series. If you know, please chime in below!

From the globally bestselling author of the Chronicles of St Mary’s and Time Police series – the origin story of bounty hunters Smallhope and Pennyroyal.

Meet Lady Amelia Smallhope, for whom there is no problem that can’t be solved by a drink and a think.

And Pennyroyal, for whom there is no problem. Ever.

Everyone’s favourite bounty hunters. Sorry – recovery agents. No bad guy they can’t handle. No expense account too flexible. No adventure too outrageous.

Join them as they settle scores, break every rule in the book and take the world by storm.

Fasten your seatbelts. The timeline doesn’t know what’s hit it.

Add to Goodreads To-Read List →

This book is on sale at:

As an Amazon Associate we earn from qualifying purchases.

We also may use affiliate links in our posts, as

well. Thanks! -

Make It Sweet

Make It Sweet by Kristen Callihan is $1.99 and a Kindle Daily Deal! Aarya mentioned this in a previous February’s Hide Your Wallet and said she was tempted by the blurb. I haven’t kept up with Callihan’s more current romances. What do you think of them?

From New York Times bestselling author Kristen Callihan comes a charming, emotional romance about redefining dreams and discovering unlikely love along the way.

Life for Emma isn’t good. The world knows her as Princess Anya on Dark Castle, but then her character gets the axe—literally. The cherry on top is finding her boyfriend in bed with another woman. She needs a break, and sanctuary comes in the form of Rosemont, a gorgeous estate in California promising rest and relaxation.

Then she meets the owner’s equally gorgeous grandson, ex–hockey player and current recluse Lucian Osmond, and she sees her own pain and yearning reflected in his eyes.

He’s charming when he wants to be but also secretive and gruff, with protective walls as thick as Emma’s own. Despite a growing attraction, they avoid each other.

But then there’s an impromptu nighttime skinny-dip, and Lucian’s luscious homemade tarts and cream cakes start arriving at Emma’s door, tempting her to taste life again…

In trying to stay apart, they only grow closer—and their broken pieces just might fit together and make them whole.

Add to Goodreads To-Read List →

This book is on sale at:

As an Amazon Associate we earn from qualifying purchases.

We also may use affiliate links in our posts, as

well. Thanks!

Don’t want to miss an ebook sale? Sign up for our newsletter, and you’ll get the week’s available deals each

Friday.

By posting a comment, you consent to have your personally identifiable information collected and used in accordance with our privacy policy.

↑ Back to Top