The U.S. Securities and Exchange Commission sued Elon Musk on Tuesday, alleging failure to timely disclose that he bought more than 5% of Twitter’s stock in 2022 before he took over the social media company.

The lawsuit, filed in a federal court in Washington, accuses Musk — tapped by Trump to co-head a so-called “Department of Government Efficiency” — of violating federal securities law because of the late disclosure.

The litigation underscores the longstanding tension between Musk, who backed President-elect Donald Trump, and the U.S. government. The eccentric billionaire has clashed with the SEC before, including over what the agency described as false and misleading statements he had posted on Twitter about taking his other company, Tesla, private.

A federal jury in San Francisco in Feb. 2023 cleared Musk of claims by Tesla investors that he defrauded them.

Under federal law, Musk was required to disclose his stake in Twitter 10 days after he acquired more than 5% of Twitter’s stock in March 2022, according to the lawsuit.

Instead, Musk disclosed his stake in Twitter in April 2022, 11 days after the regulatory deadline. By then, the billionaire had bought more 9% of Twitter’s stock. Twitter’s stock jumped more than 27% over its previous day’s closing price after Musk made the disclosure.

“As a result, Musk was able to continue purchasing shares at artificially low prices, allowing him to underpay by at least $150 million for shares he purchased after his beneficial ownership report was due,” the lawsuit states.

The action also harmed investors who didn’t know about Musk’s stake and ended up selling their Twitter shares at low prices, the SEC alleges.

Alex Spiro, Musk’s lawyer, said in a statement that “Mr. Musk has done nothing wrong and everyone sees this sham for what it is.” He accused the SEC of engaging in a “multi-year campaign of harassment” against the billionaire that “culminated in the filing of a single-count ticky tak complaint” against him.

SEC Chair Gary Gensler is stepping down Jan. 20, the day of Trump’s inauguration. In December, Trump said he would nominate Paul Atkins, a cryptocurrency advocate, to lead the securities regulator.

Musk’s big stake in Twitter was an early sign in 2022 that he might buy the company, which was struggling to attract ad dollars and compete with larger social networks such as Facebook.

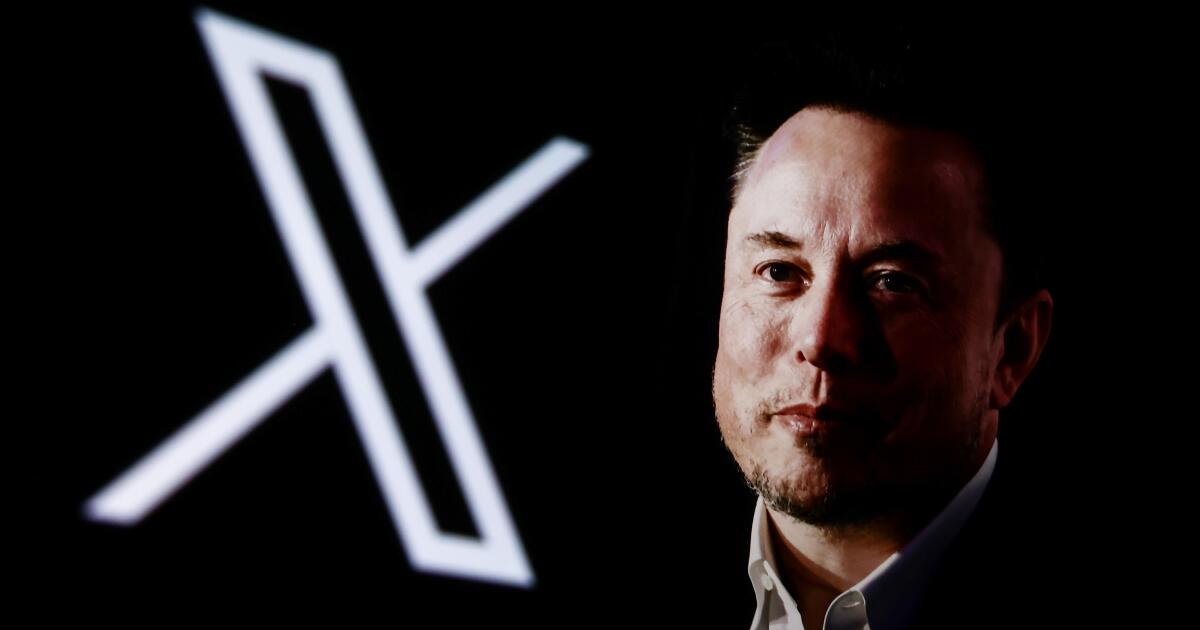

After trying to back out of buying the social media company for $44 billion, he completed his acquisition of Twitter in October 2022. Musk, who renamed Twitter to X and took the company private, said he bought the platform to promote free speech.