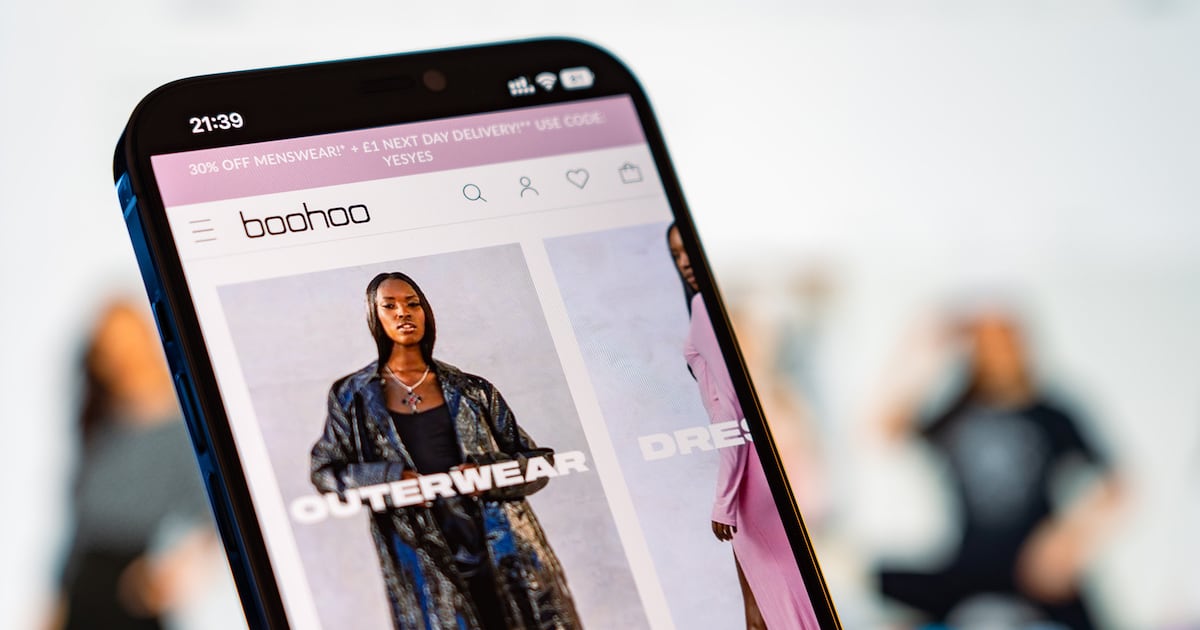

Boohoo Group Plc, which recently rebranded itself as Debenhams Group, is in talks about a debt package of as much as £175 million ($232 million), the Telegraph reported Saturday.

The discussions come as the British fast-fashion retailer faces a new financial squeeze amid tensions with Mike Ashleyâs Frasers Group Plc, which owns just over 29% of the company and previously attempted to remove its executive chairman.

Boohoo has held talks about tapping the so-called high-yield loan market for £50 million, the newspaper reported, citing people familiar with the matter who werenât identified.

The remaining £125 million is expected to come from refinancing an existing two-year loan taken out in October, according to the Telegraph.

Boohooâs new management is seeking to assess the companyâs ideal financing structure to underpin its growth plans, the company said in an emailed statement on Saturday.

âWe are currently at the early stages of evaluating our financing arrangements to ensure they best support our capital-lite, stock-lite, marketplace strategy,â the company said.

By Gabriela Mello and Jennifer Creery

Learn more:

Boohoo Rebrands as Debenhams as Youth Labels Struggle

The fast fashion group is repositioning as it looks to execute on a turnaround and distance itself from past scandal.