The Federal Reserve’s fastest-ever interest rate hikes since March 2022 have been a big headwind for a lot of stocks. But nowhere have rapid rate hikes been felt more than the fintech space, with the potential exception of regional banks.

Fintech marketplaces such as LendingClub (LC -2.76%) count regional banks as some of their key loan buyers, so when those banks had to pull back, fintech marketplaces such as LendingClub, Upstart (UPST -5.71%), and SoFi Technologies (SOFI -2.41%) were doubly hit. The results have been ugly, with these three stocks down between 76% and 92% below their all-time highs.

But as two years of rate hikes now give way to potential rate cuts later this year, could these beaten-down names rally as much as they’ve been slammed? The better-positioned ones may be, and one name in particular has big potential to achieve outsized gains in a rate-cutting cycle.

LendingClub is the only fintech marketplace to have kept its profitability

The reason LendingClub is my preference over the others is that it has, remarkably, been able to maintain profitability each and every quarter through this downturn. In 2021, LendingClub gained a banking license with the acquisition of Radius Bank. That gave LendingClub the ability to take deposits and hold loans.

As regional banks have fled LendingClub’s marketplace, those deposits gave LendingClub the ability to hold loans on its balance sheet instead of having to sell them every quarter, as it had to in the past.

Still, the current inverted yield curve also compressed net interest margins during these years. And once LendingClub ran out of capacity on its balance sheet to hold loans, it had to reduce originations as it ran out of loan buyers.

Yet LendingClub was still able to maintain profitability on a quarterly basis through the downturn, in contrast to peers:

LC Net Income (Quarterly) data by YCharts

Innovation and cost cuts made LendingClub lean and mean

LendingClub has been able to muddle through by cutting costs and innovating, which bodes well for the future. In late 2023, LendingClub cut about 14% of its workforce, as it exited expensive marketing channels and tightened its credit box.

But it wasn’t just a cost-cutting exercise that kept up profits. Even though the federal funds rate went up through late 2023 and hasn’t come down yet, LendingClub began increasing its originations again in the fourth quarter last year.

Image source: LendingClub Q2 2024 presentation.

Innovation is what helped spark this early recovery. Specifically, LendingClub was the first of the new fintech marketplaces to bring forward something called Structured Certificates, which has been very successful in attracting asset managers looking for high yields. Even though LendingClub had been concentrating on lending to higher-credit consumers, which generally provide lower yields, the new Structured Certificate program can still provide higher-yields to non-bank investors.

Structured Certificates, which LendingClub began issuing in the second quarter of 2023, work like this: LendingClub makes a personal loan, then retains 85% of the “A” note, with its asset manager customers buying 15% of the “B” note. LendingClub takes a lower yield on its 85%, but that 85% also gets paid first, with the remaining 15% B notes getting paid whatever interest is leftover after charge-offs. The result is that the higher-risk B notes can make a very high yield, while LendingClub doesn’t have to take upfront CECL charges against expected chargeoffs due to the “low-risk” nature of the A-note. Structured Certificates therefore lower LendingClub’s risk-weight on its assets, which frees up its balance sheet to make more loans. So, the Structured Certificate Program has been a huge win-win.

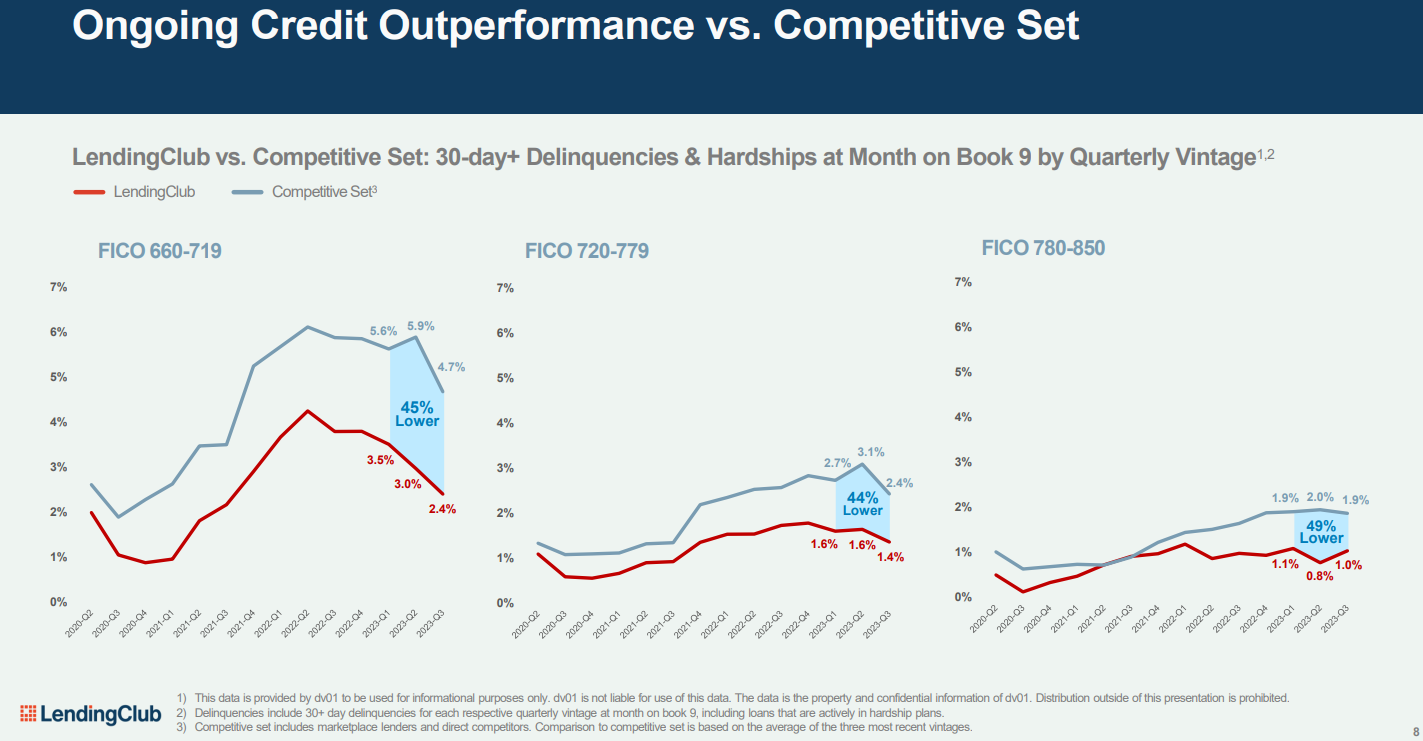

Of course, none of this would work if LendingClub’s underwriting wasn’t sound. But as one can also see, LendingClub’s data-centric approach with data going back to 2006 as the first fintech marketplace has enabled it to outperform rivals. LendingClub has achieved 40%-plus fewer 30-day delinquencies versus peers since the pandemic, as you can see:

Image source: LendingClub Q2 2024 presentation.

Positioned to rip higher when conditions moderate

Per a recent conversation I had with CFO Drew LaBenne, LendingClub is well positioned to expand quickly if interest rates come down and banks return to the platform. In our conversation, LaBenne pointed out that there’s no reason LendingClub couldn’t grow as fast as it was back in 2021, when it was essentially doubling originations year over year.

Even better, this period of tight financial conditions has forced LendingClub to streamline operations and greatly lower its fixed costs. So even though variable costs such as direct mail marketing would go up in a high-growth scenario, fixed costs wouldn’t go up nearly as much as originations in a rising market, according to LaBenne.

That could lead to substantial profit growth if originations grow back to where they were at their peak in Q2 2022, when LendingClub originated over $3.84 billion in personal loans. That compares to just $1.51 billion at the recent bottom in Q3 2023 and $1.81 billion originated last quarter.

Meanwhile, U.S. credit card and other revolving lines of consumer credit recently reached $1.3 trillion at multidecade-high rates, so there is a lot of room for LendingClub to grow when buyers return to its platform. Of note, refinancing higher-rate credit card debt is the biggest use case for LendingClub’s fixed-rate personal loans today.

LendingClub is cheaper than peers

Not only has LendingClub outperformed peers during the downturn on a profit basis and prepared itself from an upturn when interest rates fall, but it actually trades at a discount to these peers on multiple financial metrics, including price-to-book, price-to-sales, and expected forward P/E ratios.

LC Price to Book Value data by YCharts

So for those looking to play fintechs as a recovery trade as interest rates fall, LendingClub remains my clear preferred choice. It weathered the recent storm better than others, has substantial capacity to grow quickly when conditions change, and is also cheaper to boot.