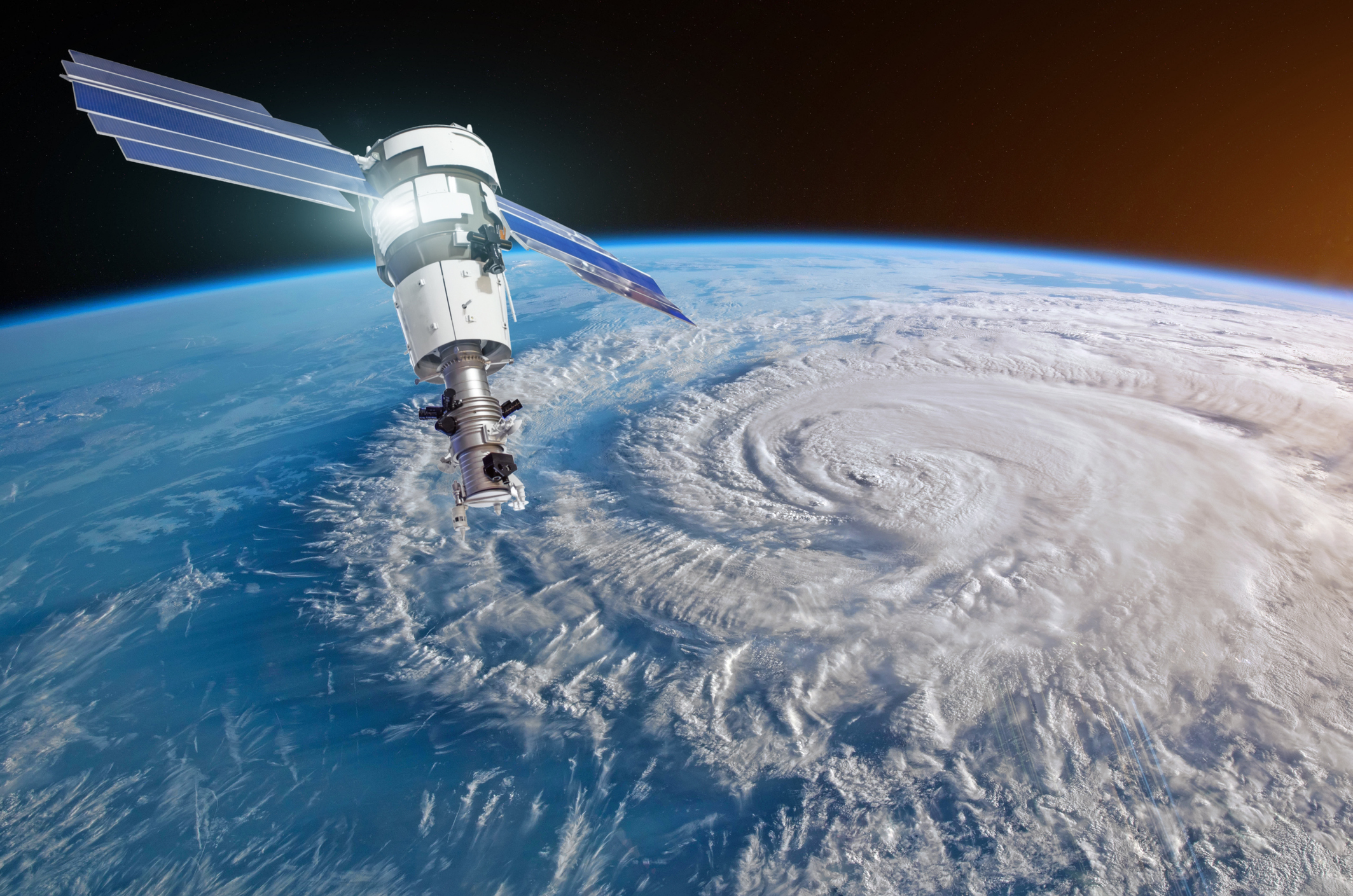

Earth observation satellite operator Planet Labs (PL 9.67%) soared 8% in a single day last month, after announcing a “six-figure deal” to help non-governmental organization (NGO) Global Fishing Watch monitor fishing vessels across the… well, the globe, actually. On Monday morning, the stock is up barely half as much — 4.5% through 10:05 a.m. ET — after announcing an analogous data deal that could be 10 times as big.

So why aren’t investors more excited?

Growing revenue at Planet Labs

This morning, Planet confirmed a “multiyear, seven-figure deal” with climate finance company Laconic, to help monitor forest growth, including “above-ground carbon, canopy height, and cover.” Planet says the images its satellites take provide “AI-powered forest carbon insights” that Laconic can use to value carbon credits and securities based on these credits as they trade globally.

Planet Labs announced this new “forest monitoring system” in September, suggesting this is a new revenue stream for the company, and that other customers in addition to Laconic may adopt it in the future, helping to grow sales for Planet Labs. And if last month’s six-figure contract is worth hundreds of thousands of dollars to Planet, this week’s seven-figure deal should be valued in the millions — roughly 10 times the value.

The opposite of disclosure

That said, Planet Labs remains frustratingly vague on the details of how it values these types of contracts. Does “six figures,” for example, refer to a contract providing $100,000 in revenue, or $999,999? And over how many years is this revenue spread?

Similarly, is a “seven-figure” contract worth $1 million, or $9 million to Planet? And is the revenue annual, or must investors take the already vague number and divide it by however many years “multiyear” refers to?

The disappointing answer is that no one really knows. Planet is making its investors guess at how much these contracts are worth, and whether they’re even material at all. Perversely for a data company, it almost seems that the more Planet Labs tells us about its contracts, the less investors actually know.

Rich Smith has positions in Planet Labs Pbc. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.